No news available.

1 Added value: Why companies align themselves sustainably

Current political developments such as the European Green Deal, Sustainable Finance, the Amendment to Sustainability Reporting and the German Supply Chain Act are increasingly demanding that

companies take responsibility for the impact of their business activities. In addition, changing demands from customers, banks, investors and other stakeholders are having a significant impact on economic activity.

The benefits of sustainability management for your company are many and varied. Sustainability management:

- offers starting points for cost savings, product and process optimization and quality assurance,

- supports legitimacy and establishes trust with your business partners, customers and employees,

- meets the requirements formulated by business partners and legislators at home and abroad,

- provides support in the competition for skilled workers,

- recognizes and reduces risks and

- can generate innovations.

The implementation of sustainability management is particularly obvious for SMEs, as they already anticipate many aspects of CSR with their commitment to corporate responsibility in the sense of honorable merchants.

If the intuitive gut feeling of responsible entrepreneurs is combined with systematic CSR management, you can make the most of your potential, improve your company's performance, stand out from the competition and make your contribution to solving current challenges.

The CSRD

10 steps to sustainability reporting

- Check affectedness

- Determine responsibility

- Provide an overview of requirements

- Carry out an inventory

- Involve stakeholders

- Carry out a materiality analysis

- Integrate sustainability into the corporate strategy

- Collect data

- Reporting

- Further development

Here you will find detailed information on the voluntary reporting standards, the EU taxonomy and the significance of reporting obligations for the financial sector.

Voluntary Reporting Standards

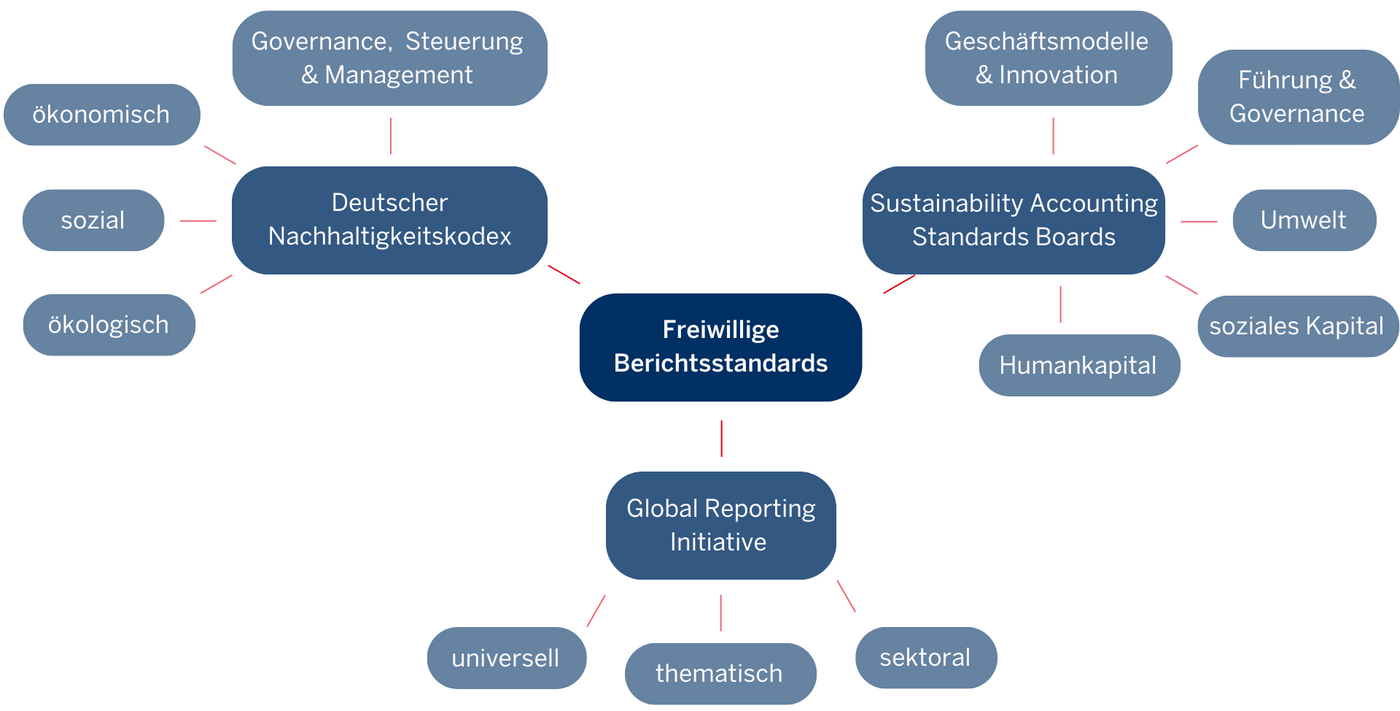

In addition to the ESRS - which are mandatory for some companies - there are also voluntary standards. Companies that are not yet required to report or that also wish to adhere to these standards set themselves apart from the competition and strengthen the trust of stakeholders.

- German Sustainability Code (DNK): The Code comprises 20 criteria in four dimensions: Ecological (four criteria), economic (six criteria), social (five criteria) and governance, control and management (five criteria). The Code is particularly suitable for small and medium-sized enterprises (SMEs). It takes into account the diversity, size and sector of the company and is tailored to Germany. The DNK database contains all declarations and reports from companies that already use the standard.

- Global Reporting Initiative (GRI): The GRI is an organization that publishes international guidelines for sustainability reports. The guidelines are suitable for companies of all sectors and sizes, but especially for those with complex value chains and multinational operations.

- Sustainability Accounting Standards Board (SASB): The SASB offers industry-specific standards for a total of 70 industries. These standards relate to topics and key figures that are particularly important for sustainable financial reporting. They are based on the topics of environment, social capital, human capital, business model and innovation as well as management and governance. The SASB is particularly suitable for listed companies with US operations.

4 Best Practices

Examples of Sustainability Reports

In the database of the German Sustainability Code (DNK) you will find a large number of public sustainability reports from companies and organizations based on various reporting standards.

- Report of the IHK Nord Westfalen (GRI Standards)

- Report of the Genoverband (GRI Standards)

- Reports of the FUNKE Media Group (ESRS)

Project “Paths to sustainability reporting with AI”

The Association of Climate Protection Companies and the Department of Environmentally Sound Products and Processes (upp) at the University of Kassel are launching a new cooperation project on April 1, 2025. The aim of the project is to use AI to automate the sustainability reporting for companies prescribed by the CSRD and to simplify the recording of Scope 3 emissions.

Detailed information on the project, including the work plan and information on costs and effort, can be found in the service catalog. The project is divided into two modules, which can be implemented either separately or in combination.

If you are interested in participating, please register by Friday, March 28, 2025 at the latest, by e-mail to geschaeftsstelle@klimaschutz-unternehmen.de

Corporate social responsibility (CSR) describes a company's responsibility for the impact of its business activities on society. The focus is not only on the social component, but also on the ecological and economic dimension. The decisive factor here is not just what happens to the profit generated, but rather how it is generated - i.e. with as little negative impact on the environment and society as possible. CSR is also not a one-off project, but a strategic approach: Responsibility is firmly anchored in the core business along the three pillars of sustainability - economic, environmental and social.

CSRD - The legal framework: The European Union's Corporate Sustainability Reporting Directive (CSRD) is the legal framework for the reporting obligation. It obliges companies above a certain size to report on how sustainable their business models and business practices are. In concrete terms, this means that companies must disclose information on various aspects of their business activities with regard to the environment, social issues and good corporate governance (environmental, social, governance = ESG). The aim of the CSRD is to create greater transparency and comparability.

ESRS - The details: The European Sustainability Reporting Standards (ESRS) specify what should ultimately be included in a CSRD-compliant sustainability report. These standards cover ESG topics and specify what information companies must disclose. As everyone has to adhere to these standards, this leads to uniform and comparable reports - and therefore to greater transparency.

Studien zum Thema

Disposable products made from renewable raw materials: How PAPSTAR is working toward its sustainability goals

1, 2, or 3? Scope categories and their relevance in sustainability reporting

Why are emissions divided into scopes? The division of greenhouse gas emissions into three so-called “scopes” (meaning scope or area of application) dates back to the Greenhouse Gas Protocol (GHG Protocol) of 2001. The standard was developed in the wake of the 1997 Kyoto Protocol, the first…

From climate target to reporting obligation: understanding and implementing transformation plans from a legal perspective

1 Why are transformation plans coming into focus now? With the European Green Deal, the European Commission presented a comprehensive growth strategy in December 2019 with the aim of making Europe the first climate-neutral continent by 2050 (European Commission, 2019). The Green Deal marks a…

Textile wholesaler L-SHOP-TEAM on the transformation: “The challenge is not to be deterred”

AI in sustainability reporting: opportunities and challenges for SMEs

1 The current state of sustainability reporting Sustainability reporting has become increasingly important in recent years, particularly due to regulatory requirements and increased social awareness of sustainable business practices. While large companies are already subject to comprehensive…