No news available.

1 How high are the financing requirements?

Major efforts are required for the sustainability and transformation of the economy. The climate-neutral and digital transformation in NRW requires high volumes of investment and financing from companies and the public sector.

According to various scenario studies, the European Union will have to invest between 758 and 1055 billion euros annually in industry, the energy sector, transport and the construction sector by 2050 in order to achieve successful decarbonization. For NRW, this means annual investments of between 61 and 85 billion euros. Other studies assume up to 91 billion euros per year.

| Original source | Original transformation path | Region of the orginal source | Yearly investments in NRW in billion euros |

| Allianz Trade | 2023-2050 | Globally | 90 |

| BCG-BDI | 2021-2023 | Germany | 91 |

| EWI | 2023-2030 | Germany | 81 |

| GCEC | 2015-2030 | Globally | 74 |

| McKinsey | 2021-2045 | Germany | 75 |

| Nextra et al. | 2021-2045 | Germany | 71 |

| OECD | 2016-2030 | Globally | 75 |

| WEF | 2016-2030 | Globally | 89 |

| Average of these studies for 2024-2045 | 81 | ||

3 What financing options do banks offer?

Banks offer a wide range of financing instruments, ranging from short-term liquidity solutions to long-term investment projects. These primarily include various loans (investment loans with longer terms, working capital loans, guarantee loans or sureties), but also leasing and mezzanine capital (e.g. convertible loans). Banks operate or already use platforms for corporate financing, e.g. to offer customers better conditions when brokering loans.

When financing sustainable or digital business models, products or processes, other factors and risks play a role in addition to the classic criteria (e.g. amortization period, expected return, availability of equity and debt capital). These include the introduction of new technologies, decarbonization, business model innovations, reputation and regulation.

The choice of the right instrument for financing transformation investments depends on the company's situation, its creditworthiness and the planned projects. Advice from the banks is essential here. Preparation, implementation and follow-up of the financing and credit discussion are of central importance.

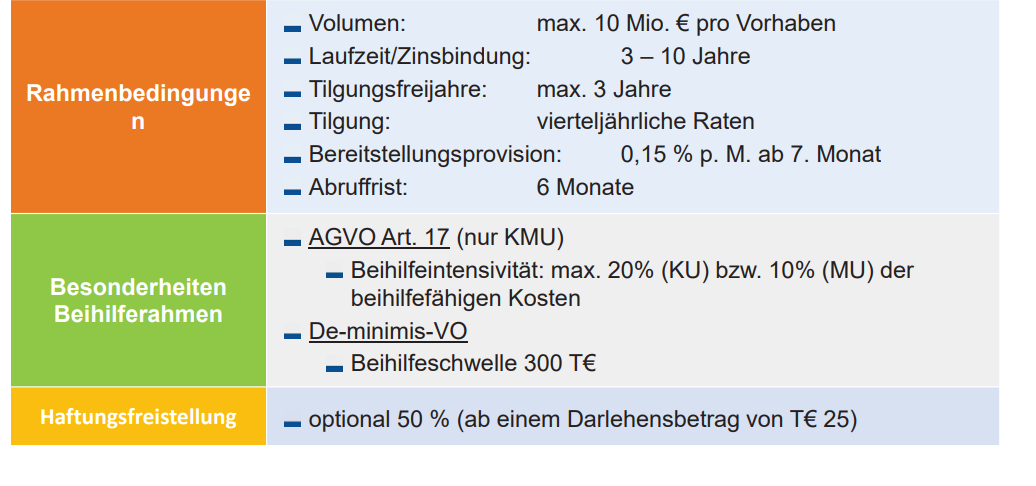

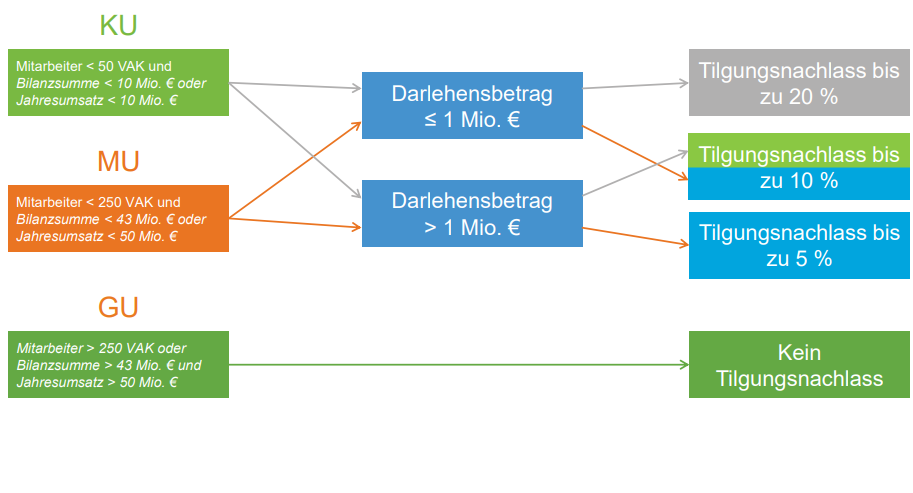

5 Subsidies from NRW.BANK

With the NRW.BANK Invest Zukunft program, NRW.BANK is offering more favourable financing conditions than ever before to support the economy. The rule of thumb is: the smaller the company and the more it invests in transformation, the greater the savings on financing costs. This is made possible by an interest rate that is 2% below the market rate and repayment discounts of up to 20%. This means that savings of up to € 2 million are possible for an investment of € 10 million. A small company that finances € 500,000 over a period of 10 years can save up to € 170,000. This makes investments profitable more quickly.

Applications for loans from the NRW.BANK.Invest Zukunft program can be submitted via the respective house bank from 19 May 2025. Until then, the house banks will be available to advise companies - as will NRW.BANK's Service Center. All further information on the subsidized investments, application eligibility and other benefits can be found on the Invest Zukunft website. Fin.Connect.NRW welcomes this strong impetus from NRW.BANK and MWIKE for the transformation of the economy.

Studien zum Thema

Venture capital as a driver of transformation in Germany and North Rhine-Westphalia

1. Background The transformation of the German economy is a major challenge. In North Rhine-Westphalia (NRW) alone, annual investments of around €100 billion are needed to successfully achieve digitalization and climate neutrality (cf. Demary et al., 2024). In addition to pure investment, however,…

Project Finance as a Lever for Climate Transformation

What are the advantages of project financing? Project financing is a financing approach for large-volume, long-term investment projects - for example in the areas of infrastructure, renewable energies (solar and wind parks), the construction of production facilities or comprehensive digitalization…

What role does the Capital Markets Union play in transformation financing?

What is the EU Capital Markets Union? The Capital Markets Union (CMU) refers to the integration and deepening of national capital markets within the European Union (EU). This is not precisely defined, but rather an integration process and the question of the form and speed in which this should and…

How can Schuldschein loans contribute to the green transformation?

What are Schuldschein loans? Schuldschein loans (Schuldschein or SSD for short; plural Schuldscheine) are a special form of loan (in accordance with Section 488 BGB and Section 344 HGB), i.e., an instrument for debt financing. In addition to companies, local authorities - such as the City of…

“We look at every investment: Could it also be sustainable?” Danny Meurs on the transformation of the hotel Der Brabander

Hotel Der Brabander in Winterberg attaches great importance to saving energy. This is why the Dutch-German family business has invested in many areas. In this interview, Management Director Danny Meurs explains how the sustainable transformation is being achieved step by step.